February 10, 2025

Excitement over making tips tax-free hasn’t led to a change in tax law, so that means businesses and employees have to play by the old rules for now.

January 27, 2025

An important deadline is coming up fast for businesses that had employees in 2024. Missing it can be costly.

January 24, 2025

The U.S. Supreme Court said CTA and BOI requirements are enforceable, but a separate nationwide injunction against the law still stands.

January 11, 2025

You’re probably familiar with the self-employment tax if you own a business. Here’s a refresher on how it works, how much it will increase, and whether there’s anything you can do to reduce it.

December 30, 2024

Less than a week after an injunction was lifted and allowed BOI rules to be enforced, the requirement is on hold again.

December 4, 2024

At least 32 million businesses faced a January deadline to comply with new CTA rules. An injunction leaves those rules in limbo.

December 1, 2024

Implementing tax-reduction strategies now can pay off when your business files its tax return in 2025.

November 14, 2024

If you’re a small business owner, travel deductions can significantly reduce your taxable income. Here’s how to make the most of them.

October 22, 2024

More than 32 million U.S. businesses are required to file beneficial ownership information (BOI) reports this year, but the clock is ticking.

September 27, 2024

Guaranteed payments to partners and payments to retired partners are just two of the tax issues that should be addressed in your partnership or LLC operating agreement.

September 18, 2024

Need another reason to maintain accurate and detailed financial statements? You’ll appreciate having them when it comes time to determine the value of your business.

September 10, 2024

With 2025 closing in fast, here are year-end moves to consider that may help your small business save on taxes.

August 30, 2024

Employers are left waiting after a court struck down – at least temporarily – a law that would ban most noncompete agreements.

August 19, 2024

The IRS has brought back a program that allows businesses to repay wrongfully gained employee retention credit money and avoid penalties.

August 9, 2024

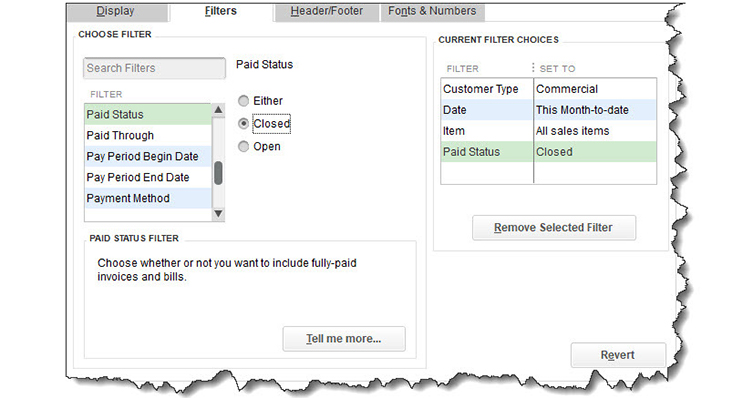

Running out of products? Or maybe stocking too many? QuickBooks Online can be a valuable tool to help solve both problems.

August 2, 2024

For most business co-owners, the value of their business shares comprises a big percentage of their estates. Having a buy-sell agreement protects co-owners and their heirs and helps avoid hassles with the IRS.

July 18, 2024

There are many tax implications to consider in the sale of business property, and they can be complex.

July 11, 2024

Do you have a viable succession plan in place for your company? Here are ways to get started and make the process easier.

June 21, 2024

Even if your business is established and on solid ground, don’t overlook the potential value of a detailed business plan.

June 16, 2024

As more companies report goodwill impairment issues and write-offs, it’s important for business owners to know the rules.

June 11, 2024

The fate of TCJA provisions could be decided by the November elections. But planning now might soften the blow of a worst-case scenario.

June 5, 2024

A FASB advisory group will focus on four big regulatory issues faced by private businesses this year and determine whether changes are needed.

May 17, 2024

There are a number of different hobbies that some taxpayers turn into businesses. Here’s how they can protect tax breaks on their tax returns.

April 11, 2024

Outsourcing payroll, also known as managed payroll, can decrease risk, increase accuracy, protect sensitive data and improve business continuity.

March 17, 2024

If your business does jobs that have related income and costs, you can use QuickBooks Online’s Projects feature to track them.

March 8, 2024

Filing threshold for business tax filings increases to $100,000, sparing more than 100,000 businesses from tax liability.

March 6, 2024

The deadline to comply with a new U.S. Department of Labor rule regarding worker classification is March 11.

March 5, 2024

Even if your startup business has little or no income tax liability, you may be eligible for a payroll tax credit election for increasing research activities. This tax break got better under the Inflation Reduction Act.

February 26, 2024

Many new ventures start out as sole proprietorships. Here are nine considerations if you’re operating a business that way.

February 18, 2024

Many employers who sought the employee retention credit aren’t even aware that they’re at risk of penalties and steep fines for making fraudulent claims. The IRS says these signs might help.

November 24, 2023

The holiday whirlwind has begun, but don’t ignore a few potential ideas for your small business to save on 2023 taxes.

October 27, 2023

Extensive reporting requirements stemming from the Corporate Transparency Act will affect many business owners starting January 1.

September 22, 2023

Identifying related parties is just one of many parts that go into preparing financial statements. Here’s why they matter, why auditors give them scrutiny, and how to avoid the risks that often accompany them.

September 12, 2023

At some point as a business owner, you might entertain the idea of selling and moving on to a new endeavor. The process of selling a business can be tedious, but having a plan in place and knowing the tax implications of a business sale can help reduce the stress and, potentially, the tax implications.

August 28, 2023

Have you connected your bank accounts to QuickBooks Online? It’s a great way to simplify your transaction tracking.

August 16, 2023

Scammers are hyping quick, easy money from the employee retention tax credit, but despite what you might hear in the slick advertisements, the IRS has a warning for employers.

March 31, 2023

Lenders will be required to compile and analyze more information about small business loan applicants under a new federal rule finalized March 30.

January 17, 2023

The cost of goods sold can account for 70% of a company’s expenses, according to recent discussions by the FASB’s Investor Advisory Committee. However, some companies skimp on details around the costs they incur to produce goods. The FASB’s disaggregation of income statement project could change that.

January 16, 2023

Every business can be an innovator. The research tax credit is a way to reward that innovation, and it comes with an intriguing feature related to payroll taxes.

December 8, 2022

Depending on the nature of your company’s operations, your balance sheet may include inventory totals. Here’s why your inventory system might be flawed and giving you the wrong numbers.

April 6, 2022

Businesses and nonprofit groups are gradually adjusting to requirements of the new lease accounting standard, such as bringing most leases onto the balance sheet. Since ASC 842 can seem confusing, here’s a quick guide to ease the adjustment period.

February 24, 2022

Being fully prepared and organized can help your financial statement audit go smoothly and ultimately save your business or organization time, money, and headaches.

December 3, 2021

Diversity, equity, and inclusion are buzzwords in modern strategic management. Here are some of the benefits that initiatives in these areas bring to public and private companies and how companies can showcase their progress in footnote disclosures and separate diversity, equity, and inclusion reports.

October 11, 2021

During the COVID-19 pandemic, many audit procedures have been performed remotely, forcing auditors to rely more heavily on analytical procedures. It’s important to understand how auditors use analytical procedures to make audits more efficient and effective.

September 2, 2021

Have you taken a few minutes to really explore QuickBooks’ report center? It’s the best way to learn about the variety of reports available from one of QuickBooks’ most powerful components.

July 3, 2021

Tennessee offers a variety of tax-saving credits. Do you know what’s available and how they could help your business?

May 11, 2021

Cybercrime isn’t just an issue for big corporations. Your small business can be a target, too. Are you protecting your QuickBooks data?

April 7, 2021

The value of an internal audit is different for everyone and can change based on circumstances, but a solid framework can provide the conditions necessary to deliver value to you.

August 7, 2020

A meticulous approach to keeping business records can protect your tax deductions and help make an audit much less painful.