January 27, 2025

An important deadline is coming up fast for businesses that had employees in 2024. Missing it can be costly.

December 30, 2024

Less than a week after an injunction was lifted and allowed BOI rules to be enforced, the requirement is on hold again.

December 4, 2024

At least 32 million businesses faced a January deadline to comply with new CTA rules. An injunction leaves those rules in limbo.

December 1, 2024

Implementing tax-reduction strategies now can pay off when your business files its tax return in 2025.

October 22, 2024

More than 32 million U.S. businesses are required to file beneficial ownership information (BOI) reports this year, but the clock is ticking.

September 18, 2024

Need another reason to maintain accurate and detailed financial statements? You’ll appreciate having them when it comes time to determine the value of your business.

August 30, 2024

Employers are left waiting after a court struck down – at least temporarily – a law that would ban most noncompete agreements.

August 19, 2024

The IRS has brought back a program that allows businesses to repay wrongfully gained employee retention credit money and avoid penalties.

August 9, 2024

Running out of products? Or maybe stocking too many? QuickBooks Online can be a valuable tool to help solve both problems.

August 2, 2024

For most business co-owners, the value of their business shares comprises a big percentage of their estates. Having a buy-sell agreement protects co-owners and their heirs and helps avoid hassles with the IRS.

July 18, 2024

There are many tax implications to consider in the sale of business property, and they can be complex.

June 21, 2024

Even if your business is established and on solid ground, don’t overlook the potential value of a detailed business plan.

June 16, 2024

As more companies report goodwill impairment issues and write-offs, it’s important for business owners to know the rules.

June 11, 2024

The fate of TCJA provisions could be decided by the November elections. But planning now might soften the blow of a worst-case scenario.

June 5, 2024

A FASB advisory group will focus on four big regulatory issues faced by private businesses this year and determine whether changes are needed.

April 11, 2024

Outsourcing payroll, also known as managed payroll, can decrease risk, increase accuracy, protect sensitive data and improve business continuity.

March 6, 2024

The deadline to comply with a new U.S. Department of Labor rule regarding worker classification is March 11.

February 27, 2024

As the manufacturing landscape continues to evolve and globalization continues to shift, many industrial businesses are assessing how mergers and acquisitions (M&A) will fit into their strategy.

February 18, 2024

Many employers who sought the employee retention credit aren’t even aware that they’re at risk of penalties and steep fines for making fraudulent claims. The IRS says these signs might help.

October 27, 2023

Extensive reporting requirements stemming from the Corporate Transparency Act will affect many business owners starting January 1.

September 22, 2023

Identifying related parties is just one of many parts that go into preparing financial statements. Here’s why they matter, why auditors give them scrutiny, and how to avoid the risks that often accompany them.

August 16, 2023

Scammers are hyping quick, easy money from the employee retention tax credit, but despite what you might hear in the slick advertisements, the IRS has a warning for employers.

June 6, 2023

(authored by RSM US LLP) Digital transformation is critical for modern manufacturing operations and the factory of the future.

April 25, 2023

Understanding new Section 174 rules is essential for business owners to prevent costly surprises and preserve cash flow.

January 17, 2023

The cost of goods sold can account for 70% of a company’s expenses, according to recent discussions by the FASB’s Investor Advisory Committee. However, some companies skimp on details around the costs they incur to produce goods. The FASB’s disaggregation of income statement project could change that.

January 16, 2023

Every business can be an innovator. The research tax credit is a way to reward that innovation, and it comes with an intriguing feature related to payroll taxes.

December 8, 2022

Depending on the nature of your company’s operations, your balance sheet may include inventory totals. Here’s why your inventory system might be flawed and giving you the wrong numbers.

April 6, 2022

Businesses and nonprofit groups are gradually adjusting to requirements of the new lease accounting standard, such as bringing most leases onto the balance sheet. Since ASC 842 can seem confusing, here’s a quick guide to ease the adjustment period.

February 24, 2022

Being fully prepared and organized can help your financial statement audit go smoothly and ultimately save your business or organization time, money, and headaches.

December 3, 2021

Diversity, equity, and inclusion are buzzwords in modern strategic management. Here are some of the benefits that initiatives in these areas bring to public and private companies and how companies can showcase their progress in footnote disclosures and separate diversity, equity, and inclusion reports.

October 11, 2021

During the COVID-19 pandemic, many audit procedures have been performed remotely, forcing auditors to rely more heavily on analytical procedures. It’s important to understand how auditors use analytical procedures to make audits more efficient and effective.

September 2, 2021

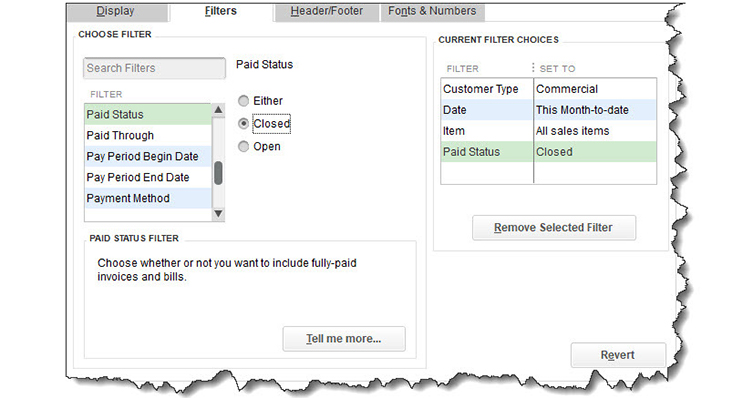

Have you taken a few minutes to really explore QuickBooks’ report center? It’s the best way to learn about the variety of reports available from one of QuickBooks’ most powerful components.

July 3, 2021

Tennessee offers a variety of tax-saving credits. Do you know what’s available and how they could help your business?

May 11, 2021

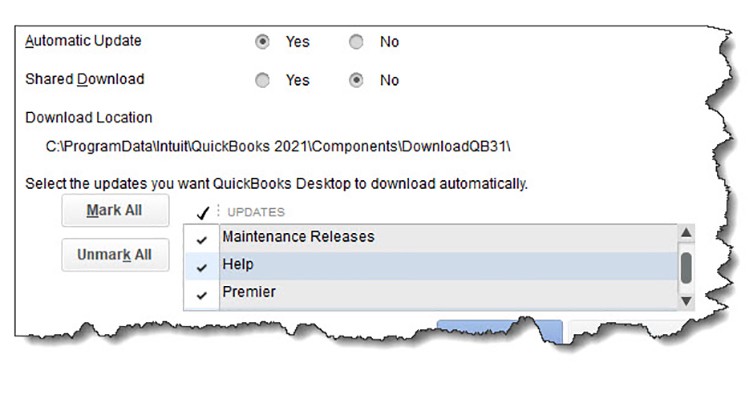

Cybercrime isn’t just an issue for big corporations. Your small business can be a target, too. Are you protecting your QuickBooks data?

April 7, 2021

The value of an internal audit is different for everyone and can change based on circumstances, but a solid framework can provide the conditions necessary to deliver value to you.