Users of QuickBooks already know how it’s transformed their daily bookkeeping practices. Users can create sales forms like invoices quickly and find them when they need them. Customer and vendor records are organized and stored neatly for fast retrieval. And it’s easy to accept online payments, track inventory, and record billable time.

But if you’re not using QuickBooks’ built-in reports, you’re missing out on one of the software’s most powerful components. While you can look at lists of invoices, sales receipts, and payments, you can’t see in a few seconds who owes you money and how late they are in paying, for example. You’re not able to get an instant overview of who you owe. You can’t call up a customer’s history instantly, and it will take an enormous amount of time to see which of your items and services are selling and which aren’t.

These are just a few of the insights you get from using QuickBooks reports. Beyond learning about your company’s past and present financial states, you can make better business decisions that will improve your future.

Before you start

QuickBooks’ reports are exceptionally customizable, as you’ll see. But before you start creating them, you should see what your general report options are. Open the Edit menu and select Preferences, then Company Preferences (which only administrators can modify).

You’ll see that you can control your reports’ general settings. For example, some reports can be created on the basis of either Accrual or Cash. You can designate your preference here. Do you want the aging process to begin on the due date or transaction date? How much information should appear when Items or Accounts are displayed? What additional data should appear on your report pages (Report Title, Date Prepared, Report Basis, etc.)? You can specify your own Format or just accept the Default.

Note that Statement of Cash Flows is an advanced report, one we don’t recommend you try to modify or analyze on your own. We can help with that when the report is needed, which is usually monthly or quarterly.

When you’re done here, click OK.

Learn what’s there

The best way to familiarize yourself with the reports that QuickBooks offers is to open the Reports menu and click Report Center. The content here is divided by type (Customers & Receivables, Sales, Purchases, etc.). Click around these lists and use the icons in each box to Run the current report, get more Info on it, mark it as one of your Favorites, or view a Help file. You can choose the date range before you run it with your company’s own data.

Customizing your content

We mentioned before how customizable QuickBooks’ reports are. Customization options vary from report to report, but we’ll look at one example here. You’re likely to want to run Sales by Item Detail frequently to see what your most popular items are as well as what’s not doing so well. Find it in the Report Center by clicking the Sales tab, selecting it, and clicking Run. If you don’t have a lot of data in QuickBooks yet, open one of the sample files that came with the software (File | Open Previous Company).

With the report open, click Customize Report in the upper left corner and see that there are four tabs here. Click on each to see what your options are.

- Display. Includes options like Report Date Range and Columns.

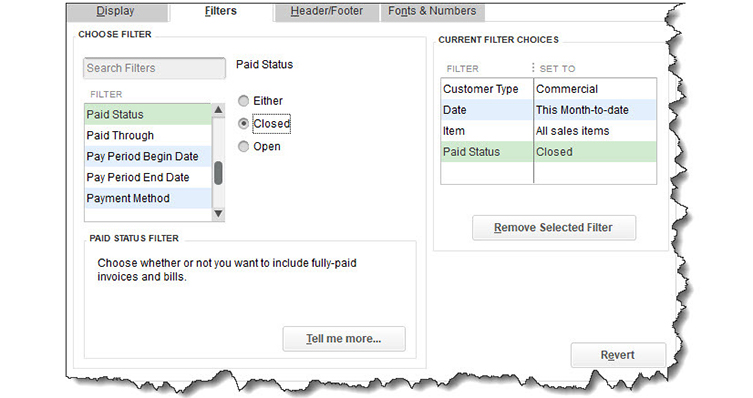

- Filters. What cross-section of your QuickBooks data do you want to see? Choose a filter, and the middle column will change to reflect your options there. You can add and remove as many filters as you’d like.

- Header/Footer. If you want to change the settings you established in Company Preferences, you can do so here.

- Fonts & Numbers. Contains display options.

When you’ve finished customizing your report, click OK to create it. Your modified report format will not be saved unless you click Memorize and give it a name.

You can customize and run many QuickBooks reports yourself, or reach out to a KraftCPAs QuickBooks Professional for help understanding how QuickBooks reports can help you make better business decisions.

© 2021