January 27, 2025

An important deadline is coming up fast for businesses that had employees in 2024. Missing it can be costly.

December 4, 2024

At least 32 million businesses faced a January deadline to comply with new CTA rules. An injunction leaves those rules in limbo.

December 1, 2024

Implementing tax-reduction strategies now can pay off when your business files its tax return in 2025.

October 22, 2024

More than 32 million U.S. businesses are required to file beneficial ownership information (BOI) reports this year, but the clock is ticking.

October 8, 2024

It can be a challenge to keep your financial records as healthy as your patients, but there are ways to do both.

September 18, 2024

Need another reason to maintain accurate and detailed financial statements? You’ll appreciate having them when it comes time to determine the value of your business.

August 30, 2024

Employers are left waiting after a court struck down – at least temporarily – a law that would ban most noncompete agreements.

August 20, 2024

Disability income may or may not be taxable by the federal government. Here are the basic rules.

August 19, 2024

The IRS has brought back a program that allows businesses to repay wrongfully gained employee retention credit money and avoid penalties.

July 18, 2024

There are many tax implications to consider in the sale of business property, and they can be complex.

June 21, 2024

Even if your business is established and on solid ground, don’t overlook the potential value of a detailed business plan.

June 16, 2024

As more companies report goodwill impairment issues and write-offs, it’s important for business owners to know the rules.

June 11, 2024

The fate of TCJA provisions could be decided by the November elections. But planning now might soften the blow of a worst-case scenario.

May 13, 2024

Comprehensive financial reporting often isn’t a priority for many dental practices, but it’s a growing necessity in a competitive marketplace.

February 23, 2024

(authored by RSM US LLP) As margins struggle to rebound to pre-pandemic levels, strategic partnerships are expected to rise in health care this year.

February 18, 2024

Many employers who sought the employee retention credit aren’t even aware that they’re at risk of penalties and steep fines for making fraudulent claims. The IRS says these signs might help.

October 27, 2023

Extensive reporting requirements stemming from the Corporate Transparency Act will affect many business owners starting January 1.

September 22, 2023

Identifying related parties is just one of many parts that go into preparing financial statements. Here’s why they matter, why auditors give them scrutiny, and how to avoid the risks that often accompany them.

September 22, 2023

Healthcare organizations have significant financial incentives to capitalize on tax credits available from the IRA when investing in clean energy assets.

August 25, 2023

Healthcare organizations that fail to continuously monitor their cyber insurance coverage become at risk due to escalating security challenges.

August 16, 2023

Scammers are hyping quick, easy money from the employee retention tax credit, but despite what you might hear in the slick advertisements, the IRS has a warning for employers.

July 31, 2023

The role of artificial intelligence continues to grow in the healthcare industry, where organizations and providers are finding ways for AI to fill gaps in staffing and improve the overall experience for clients and customers.

June 5, 2023

The tax-exempt status of nonprofit hospitals is under scrutiny as Congress determines whether the benefit equates to the value provided to local communities.

May 27, 2022

Medicare bad debts present rural health clinics and other Medicare Part A providers an opportunity to recover reimbursement dollars they might otherwise miss.

April 6, 2022

Businesses and nonprofit groups are gradually adjusting to requirements of the new lease accounting standard, such as bringing most leases onto the balance sheet. Since ASC 842 can seem confusing, here’s a quick guide to ease the adjustment period.

February 24, 2022

Being fully prepared and organized can help your financial statement audit go smoothly and ultimately save your business or organization time, money, and headaches.

December 3, 2021

Diversity, equity, and inclusion are buzzwords in modern strategic management. Here are some of the benefits that initiatives in these areas bring to public and private companies and how companies can showcase their progress in footnote disclosures and separate diversity, equity, and inclusion reports.

October 11, 2021

During the COVID-19 pandemic, many audit procedures have been performed remotely, forcing auditors to rely more heavily on analytical procedures. It’s important to understand how auditors use analytical procedures to make audits more efficient and effective.

September 2, 2021

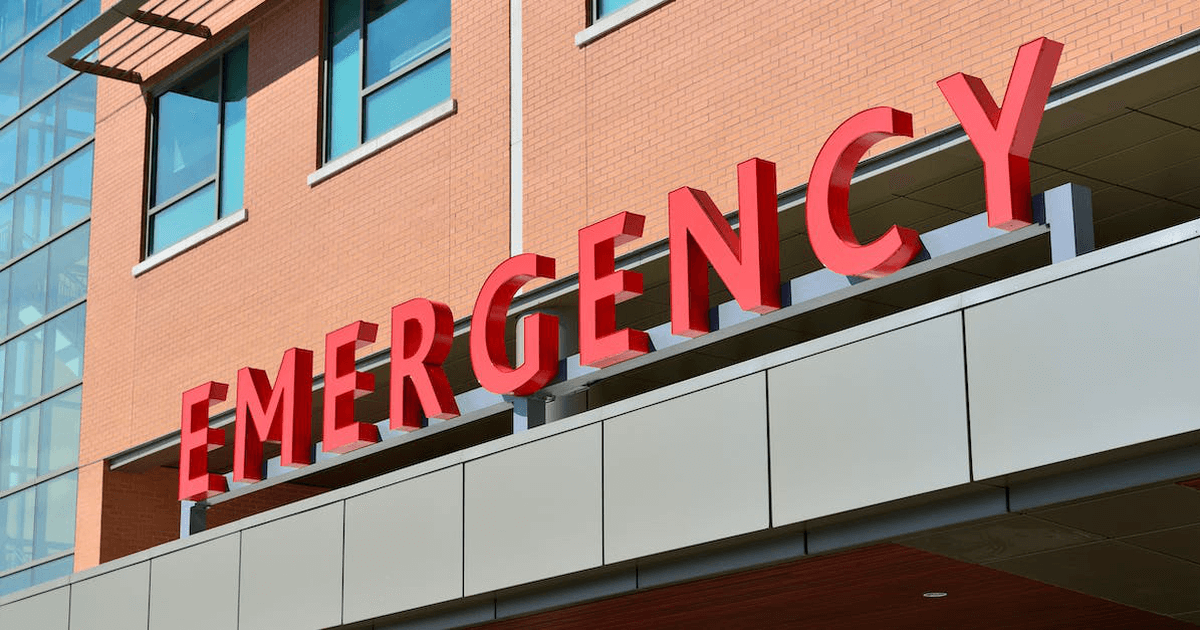

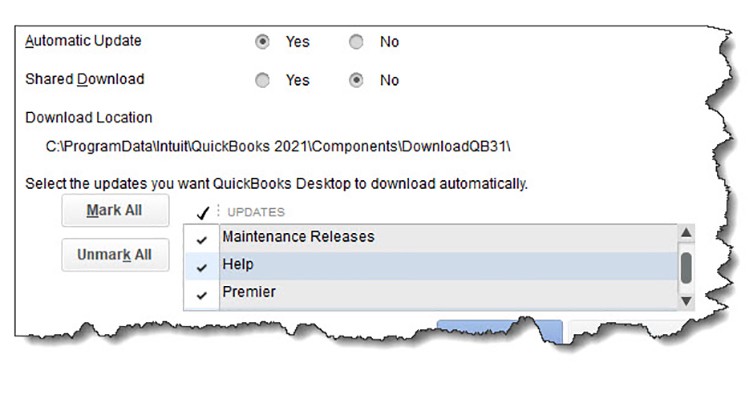

Have you taken a few minutes to really explore QuickBooks’ report center? It’s the best way to learn about the variety of reports available from one of QuickBooks’ most powerful components.

July 3, 2021

Tennessee offers a variety of tax-saving credits. Do you know what’s available and how they could help your business?

May 11, 2021

Cybercrime isn’t just an issue for big corporations. Your small business can be a target, too. Are you protecting your QuickBooks data?

April 7, 2021

The value of an internal audit is different for everyone and can change based on circumstances, but a solid framework can provide the conditions necessary to deliver value to you.

July 29, 2020

Kraft Healthcare Consulting LLC president Scott Mertie has been appointed to the board of directors for the Nashville Health Care Council for 2020-2021. Scott is one of 15 new members chosen for the board.

February 27, 2020

The Nashville Business Journal’s annual list recognizes the area’s most influential professionals in the healthcare industry.

September 21, 2019

There are a variety of cyber vulnerabilities that can impact medical devices, especially as these devices within a hospital or health system become more and more connected.

September 5, 2019

Scott’s debut on the NBJ’s annual Most Admired CEOs list follows his recent recognition in the publication’s Power Leaders in Accounting, as well as their Health Care Awards.

March 7, 2019

KHC’s Scott Mertie teamed up with the AIHC to create a specialized training program and credential for cost reporting professionals.

May 11, 2018

Less than two months into President Donald Trump’s White House tenure, the Nashville Health Care Council’s Leadership Health Care (LHC) initiative led a group of more than 100 healthcare leaders on its annual two-day delegation to Washington, D.C.

October 11, 2017

Scott R. Mertie of Kraft Healthcare Consulting, LLC (KHC) was selected by the German American Chamber of Commerce® of the Midwest, Inc. (GACC Midwest) to participate in an exclusive international health and technology delegation in Germany.

June 8, 2017

Any entity that handles health information or other sensitive data should be intimately familiar with HIPAA, HITECH, and HITRUST.

May 24, 2017

Healthcare systems are seeing global transformation, with governments and providers trying to reconcile increased costs with rising demand for greater accessibility and higher-quality care. In March, Scott Mertie, president of Kraft Healthcare Consulting, LLC, participated in the Nashville Health Care Council’s 2017 International Health Care Study Mission to the United Kingdom.

April 30, 2013

Scott Mertie was part of a delegation of approximately 30 healthcare leaders to visit Paris in April — a trip spearheaded by the Nashville Health Care Council (NHCC).

June 14, 2010

Scott Mertie traveled to London, England and Edinburgh, Scotland on a Health Care Study Mission.

November 11, 2009

Scott Mertie and Kevin Crumbo accompanied Governor Bredesen and Economic Community Development Commissioner Matt Kisber on individual trade missions to China and Japan.