February 10, 2025

Excitement over making tips tax-free hasn’t led to a change in tax law, so that means businesses and employees have to play by the old rules for now.

January 27, 2025

An important deadline is coming up fast for businesses that had employees in 2024. Missing it can be costly.

January 24, 2025

The U.S. Supreme Court said CTA and BOI requirements are enforceable, but a separate nationwide injunction against the law still stands.

January 11, 2025

You’re probably familiar with the self-employment tax if you own a business. Here’s a refresher on how it works, how much it will increase, and whether there’s anything you can do to reduce it.

December 30, 2024

Less than a week after an injunction was lifted and allowed BOI rules to be enforced, the requirement is on hold again.

December 4, 2024

At least 32 million businesses faced a January deadline to comply with new CTA rules. An injunction leaves those rules in limbo.

December 1, 2024

Implementing tax-reduction strategies now can pay off when your business files its tax return in 2025.

November 14, 2024

If you’re a small business owner, travel deductions can significantly reduce your taxable income. Here’s how to make the most of them.

October 22, 2024

More than 32 million U.S. businesses are required to file beneficial ownership information (BOI) reports this year, but the clock is ticking.

October 8, 2024

It can be a challenge to keep your financial records as healthy as your patients, but there are ways to do both.

October 1, 2024

When you buy a house, can you deduct seller-paid points on your tax return? Here are the rules.

September 27, 2024

Guaranteed payments to partners and payments to retired partners are just two of the tax issues that should be addressed in your partnership or LLC operating agreement.

September 27, 2024

Construction businesses that work on clean energy projects may have some great opportunities ahead. Here’s a look at the substantial tax incentives involved.

September 18, 2024

Need another reason to maintain accurate and detailed financial statements? You’ll appreciate having them when it comes time to determine the value of your business.

September 10, 2024

With 2025 closing in fast, here are year-end moves to consider that may help your small business save on taxes.

September 9, 2024

Ken Youngstead, a practice leader for the KraftCPAs nonprofit industry team, begins term as the Nashville chapter’s president-elect.

August 30, 2024

Employers are left waiting after a court struck down – at least temporarily – a law that would ban most noncompete agreements.

August 23, 2024

If you’re the owner of a pass-through entity, the federal income tax rules for gains from the sale of business real estate or vacant land may be more complex than you imagined.

August 20, 2024

Disability income may or may not be taxable by the federal government. Here are the basic rules.

August 19, 2024

The IRS has brought back a program that allows businesses to repay wrongfully gained employee retention credit money and avoid penalties.

August 9, 2024

Running out of products? Or maybe stocking too many? QuickBooks Online can be a valuable tool to help solve both problems.

August 2, 2024

For most business co-owners, the value of their business shares comprises a big percentage of their estates. Having a buy-sell agreement protects co-owners and their heirs and helps avoid hassles with the IRS.

July 24, 2024

The federal estate tax exemption is $13.61 million, so now is the time to think about saving income taxes for your heirs rather than worrying about estate taxes.

July 18, 2024

There are many tax implications to consider in the sale of business property, and they can be complex.

July 11, 2024

Do you have a viable succession plan in place for your company? Here are ways to get started and make the process easier.

June 21, 2024

Even if your business is established and on solid ground, don’t overlook the potential value of a detailed business plan.

June 16, 2024

As more companies report goodwill impairment issues and write-offs, it’s important for business owners to know the rules.

June 11, 2024

The fate of TCJA provisions could be decided by the November elections. But planning now might soften the blow of a worst-case scenario.

June 7, 2024

If you’re 62 or older and own a highly appreciated house, a reverse mortgage may provide a way to stay in the home for your lifetime, gain extra income, and receive a tax-saving bonus.

June 5, 2024

A FASB advisory group will focus on four big regulatory issues faced by private businesses this year and determine whether changes are needed.

May 17, 2024

There are a number of different hobbies that some taxpayers turn into businesses. Here’s how they can protect tax breaks on their tax returns.

May 16, 2024

In the construction industry, these two common accounting problems tend to give contractors the biggest headaches.

May 13, 2024

Comprehensive financial reporting often isn’t a priority for many dental practices, but it’s a growing necessity in a competitive marketplace.

April 17, 2024

In some parts of the United States, rental property is a hot commodity. If you’ve considered getting into the race by turning your house into a rental, consider the ups and downs of being a landlord.

April 11, 2024

Outsourcing payroll, also known as managed payroll, can decrease risk, increase accuracy, protect sensitive data and improve business continuity.

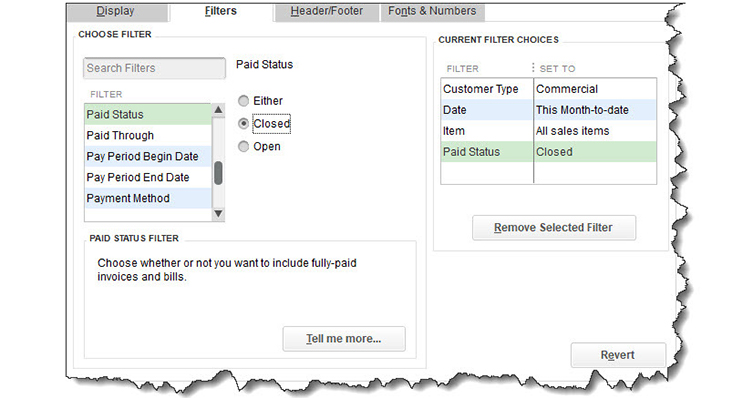

March 17, 2024

If your business does jobs that have related income and costs, you can use QuickBooks Online’s Projects feature to track them.

March 8, 2024

Filing threshold for business tax filings increases to $100,000, sparing more than 100,000 businesses from tax liability.

March 6, 2024

The deadline to comply with a new U.S. Department of Labor rule regarding worker classification is March 11.

March 5, 2024

Even if your startup business has little or no income tax liability, you may be eligible for a payroll tax credit election for increasing research activities. This tax break got better under the Inflation Reduction Act.

February 27, 2024

As the manufacturing landscape continues to evolve and globalization continues to shift, many industrial businesses are assessing how mergers and acquisitions (M&A) will fit into their strategy.

February 26, 2024

Many new ventures start out as sole proprietorships. Here are nine considerations if you’re operating a business that way.

February 23, 2024

(authored by RSM US LLP) As margins struggle to rebound to pre-pandemic levels, strategic partnerships are expected to rise in health care this year.

February 18, 2024

Many employers who sought the employee retention credit aren’t even aware that they’re at risk of penalties and steep fines for making fraudulent claims. The IRS says these signs might help.

January 7, 2024

Construction businesses are familiar with the challenges and opportunities associated with change orders. Here are some ways to tighten up your change order management process.

January 3, 2024

The real estate market can be tricky, but there’s still big profit potential on business property. In these cases, a “like-kind” exchange may be attractive when selling commercial or investment real estate.

November 24, 2023

The holiday whirlwind has begun, but don’t ignore a few potential ideas for your small business to save on 2023 taxes.

November 22, 2023

The FDIC has proposed guidelines on corporate governance and risk management practices for banks with $10 billion or more in assets.

October 27, 2023

Extensive reporting requirements stemming from the Corporate Transparency Act will affect many business owners starting January 1.

October 27, 2023

Smaller donations and gifts from lower-income donors have consistently dropped. This is why analyzing the giving trends of more affluent donors is critical for nonprofits.

October 3, 2023

Estimating is among the most important areas of proficiency for any construction business. Here are 10 ways to potentially improve your company’s estimates.

September 22, 2023

Identifying related parties is just one of many parts that go into preparing financial statements. Here’s why they matter, why auditors give them scrutiny, and how to avoid the risks that often accompany them.

September 22, 2023

Healthcare organizations have significant financial incentives to capitalize on tax credits available from the IRA when investing in clean energy assets.

September 12, 2023

At some point as a business owner, you might entertain the idea of selling and moving on to a new endeavor. The process of selling a business can be tedious, but having a plan in place and knowing the tax implications of a business sale can help reduce the stress and, potentially, the tax implications.

September 8, 2023

The SECURE 2.0 Act’s new retirement catch-up contribution rules caused problems and confusion for employers and employees alike. The IRS has now provided guidance.

September 6, 2023

Make the most of estate and gift tax exemptions now before deduction limits change in 2026.

August 28, 2023

Have you connected your bank accounts to QuickBooks Online? It’s a great way to simplify your transaction tracking.

August 25, 2023

Healthcare organizations that fail to continuously monitor their cyber insurance coverage become at risk due to escalating security challenges.

August 22, 2023

Discover how the generation-skipping tax could impact your estate planning.

August 16, 2023

Scammers are hyping quick, easy money from the employee retention tax credit, but despite what you might hear in the slick advertisements, the IRS has a warning for employers.

August 15, 2023

Regulators provide new risk management guidance for banks partnering with third-party organizations.

July 31, 2023

The role of artificial intelligence continues to grow in the healthcare industry, where organizations and providers are finding ways for AI to fill gaps in staffing and improve the overall experience for clients and customers.

July 28, 2023

How well do you know AI and its capabilities? Find out what AI can and can’t do in the nonprofit sector, as well as five of the biggest AI myths and the truth behind each one.

July 3, 2023

Financial institutions face a rapidly evolving business environment. Here are five ways financial institutions can ensure the efficient allocation of IT spending.

June 6, 2023

(authored by RSM US LLP) Digital transformation is critical for modern manufacturing operations and the factory of the future.

June 5, 2023

The tax-exempt status of nonprofit hospitals is under scrutiny as Congress determines whether the benefit equates to the value provided to local communities.

May 30, 2023

You’ve probably heard that probate should be avoided in estate planning. But what does that mean, and how is it done?

April 25, 2023

Understanding new Section 174 rules is essential for business owners to prevent costly surprises and preserve cash flow.

March 31, 2023

Lenders will be required to compile and analyze more information about small business loan applicants under a new federal rule finalized March 30.

March 28, 2023

Bank collapses in the U.S. aren’t common, but when it happens, it can be a harrowing experience for customers whose money is at risk. Limit your potential losses by remembering these key points of FDIC coverage.

March 22, 2023

For construction businesses, the cost of insurance can be high, but the cost of going without it can be so much worse. Let’s review a few important types of coverage.

February 27, 2023

Higher costs for labor and materials are still putting a chill on profitability for many construction companies. These eight steps might seem simple, but overlooking just one could cost you money.

January 27, 2023

Fraud is an ever-present threat for construction businesses, both in the office and on jobsites. That’s why contractors must leave no stone unturned when trying to prevent it.

January 17, 2023

The cost of goods sold can account for 70% of a company’s expenses, according to recent discussions by the FASB’s Investor Advisory Committee. However, some companies skimp on details around the costs they incur to produce goods. The FASB’s disaggregation of income statement project could change that.

January 16, 2023

Every business can be an innovator. The research tax credit is a way to reward that innovation, and it comes with an intriguing feature related to payroll taxes.

December 8, 2022

Depending on the nature of your company’s operations, your balance sheet may include inventory totals. Here’s why your inventory system might be flawed and giving you the wrong numbers.

May 27, 2022

Medicare bad debts present rural health clinics and other Medicare Part A providers an opportunity to recover reimbursement dollars they might otherwise miss.

April 23, 2022

Misunderstanding the complex rules of tracking employee hours can lead to errors, confusion, and wasted hours. Here are a few ways to hold the line for your next construction project.

April 6, 2022

Businesses and nonprofit groups are gradually adjusting to requirements of the new lease accounting standard, such as bringing most leases onto the balance sheet. Since ASC 842 can seem confusing, here’s a quick guide to ease the adjustment period.

February 24, 2022

Being fully prepared and organized can help your financial statement audit go smoothly and ultimately save your business or organization time, money, and headaches.

December 3, 2021

Diversity, equity, and inclusion are buzzwords in modern strategic management. Here are some of the benefits that initiatives in these areas bring to public and private companies and how companies can showcase their progress in footnote disclosures and separate diversity, equity, and inclusion reports.

October 11, 2021

During the COVID-19 pandemic, many audit procedures have been performed remotely, forcing auditors to rely more heavily on analytical procedures. It’s important to understand how auditors use analytical procedures to make audits more efficient and effective.

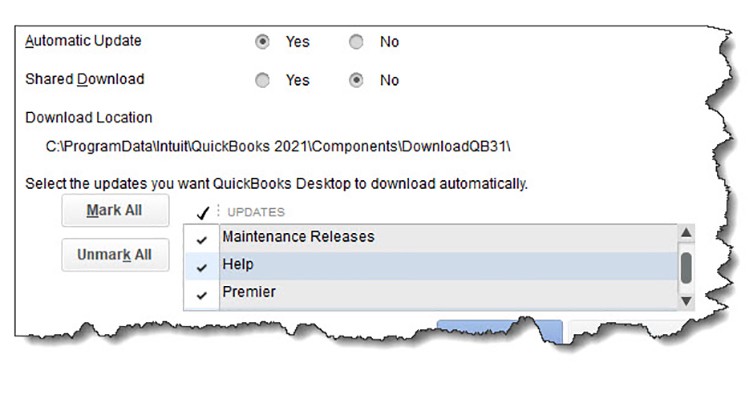

September 2, 2021

Have you taken a few minutes to really explore QuickBooks’ report center? It’s the best way to learn about the variety of reports available from one of QuickBooks’ most powerful components.

July 3, 2021

Tennessee offers a variety of tax-saving credits. Do you know what’s available and how they could help your business?

May 11, 2021

Cybercrime isn’t just an issue for big corporations. Your small business can be a target, too. Are you protecting your QuickBooks data?

April 7, 2021

The value of an internal audit is different for everyone and can change based on circumstances, but a solid framework can provide the conditions necessary to deliver value to you.

August 7, 2020

A meticulous approach to keeping business records can protect your tax deductions and help make an audit much less painful.

July 29, 2020

Kraft Healthcare Consulting LLC president Scott Mertie has been appointed to the board of directors for the Nashville Health Care Council for 2020-2021. Scott is one of 15 new members chosen for the board.

February 27, 2020

The Nashville Business Journal’s annual list recognizes the area’s most influential professionals in the healthcare industry.

September 21, 2019

There are a variety of cyber vulnerabilities that can impact medical devices, especially as these devices within a hospital or health system become more and more connected.

September 5, 2019

Scott’s debut on the NBJ’s annual Most Admired CEOs list follows his recent recognition in the publication’s Power Leaders in Accounting, as well as their Health Care Awards.

March 7, 2019

KHC’s Scott Mertie teamed up with the AIHC to create a specialized training program and credential for cost reporting professionals.

May 11, 2018

Less than two months into President Donald Trump’s White House tenure, the Nashville Health Care Council’s Leadership Health Care (LHC) initiative led a group of more than 100 healthcare leaders on its annual two-day delegation to Washington, D.C.

October 11, 2017

Scott R. Mertie of Kraft Healthcare Consulting, LLC (KHC) was selected by the German American Chamber of Commerce® of the Midwest, Inc. (GACC Midwest) to participate in an exclusive international health and technology delegation in Germany.

June 8, 2017

Any entity that handles health information or other sensitive data should be intimately familiar with HIPAA, HITECH, and HITRUST.

May 24, 2017

Healthcare systems are seeing global transformation, with governments and providers trying to reconcile increased costs with rising demand for greater accessibility and higher-quality care. In March, Scott Mertie, president of Kraft Healthcare Consulting, LLC, participated in the Nashville Health Care Council’s 2017 International Health Care Study Mission to the United Kingdom.

April 30, 2013

Scott Mertie was part of a delegation of approximately 30 healthcare leaders to visit Paris in April — a trip spearheaded by the Nashville Health Care Council (NHCC).

June 14, 2010

Scott Mertie traveled to London, England and Edinburgh, Scotland on a Health Care Study Mission.

November 11, 2009

Scott Mertie and Kevin Crumbo accompanied Governor Bredesen and Economic Community Development Commissioner Matt Kisber on individual trade missions to China and Japan.