January 27, 2025

An important deadline is coming up fast for businesses that had employees in 2024. Missing it can be costly.

December 30, 2024

Less than a week after an injunction was lifted and allowed BOI rules to be enforced, the requirement is on hold again.

August 19, 2024

The IRS has brought back a program that allows businesses to repay wrongfully gained employee retention credit money and avoid penalties.

June 16, 2024

As more companies report goodwill impairment issues and write-offs, it’s important for business owners to know the rules.

March 6, 2024

The deadline to comply with a new U.S. Department of Labor rule regarding worker classification is March 11.

April 6, 2022

Businesses and nonprofit groups are gradually adjusting to requirements of the new lease accounting standard, such as bringing most leases onto the balance sheet. Since ASC 842 can seem confusing, here’s a quick guide to ease the adjustment period.

December 3, 2021

Diversity, equity, and inclusion are buzzwords in modern strategic management. Here are some of the benefits that initiatives in these areas bring to public and private companies and how companies can showcase their progress in footnote disclosures and separate diversity, equity, and inclusion reports.

September 2, 2021

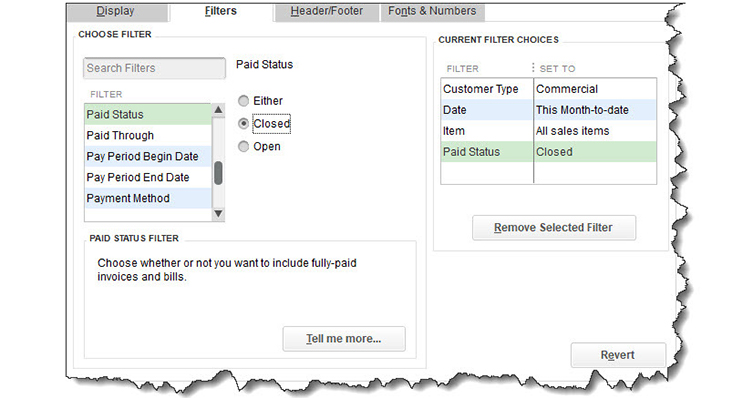

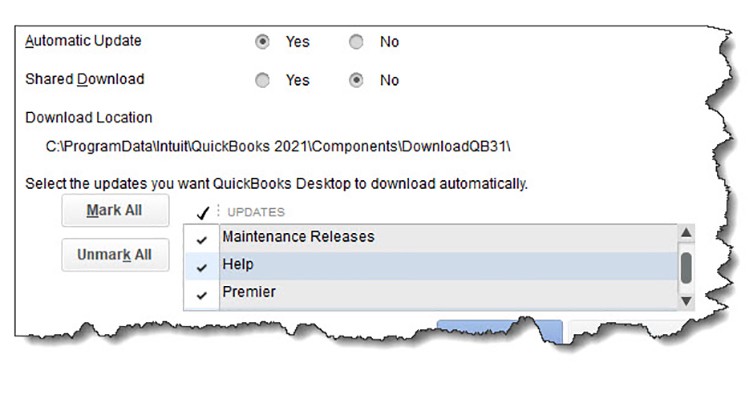

Have you taken a few minutes to really explore QuickBooks’ report center? It’s the best way to learn about the variety of reports available from one of QuickBooks’ most powerful components.

May 11, 2021

Cybercrime isn’t just an issue for big corporations. Your small business can be a target, too. Are you protecting your QuickBooks data?