2024-2025 Tax Planning Guide

2024-2025 Tax Planning Guide

Solutions to your most common tax filing situations are just a click away.

2025 Tax Deadlines

2025 Tax Deadlines

It's not easy to keep track of a full year of complex tax deadlines. This list highlights the dates to remember for individuals and employers.

2025 Calculation of Effective Federal Tax Rates

2025 Calculation of Effective Federal Tax Rates

Use our guide to quickly determine the marginal, federal, and effective tax rates for your current filing status.

BOI Compliance Guide

BOI Compliance Guide

Beneficial Ownership Information (BOI) requirements went into effect January 1, 2024, for many U.S. businesses. This guide explains the details.

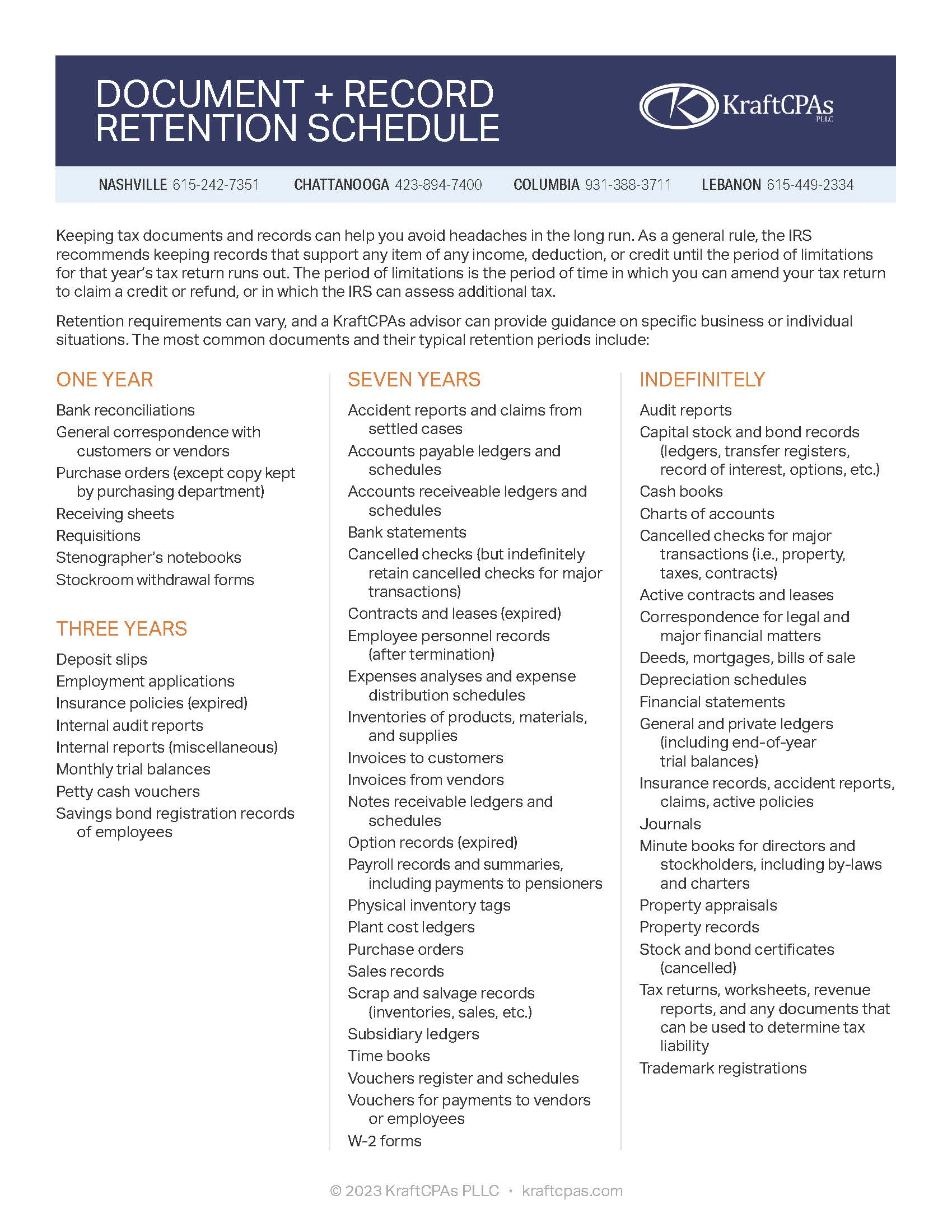

Document and Record Retention Schedule

Document and Record Retention Schedule

Keeping certain tax documents and records can help you avoid headaches in the long run. Here are some of the most common documents and suggested retention period.

Peer Review Report

Peer Review Report

Our most recent peer review report for the year ending September 30, 2023, was issued in March 2024.

Choosing A Retirement Solution

Choosing A Retirement Solution

There are a variety of options to consider when deciding on the right employee benefit plan for your business. This guide will provide insight.